Introduction

In the world of business, there are a multitude of factors that contribute to success. Among these, one of the most overlooked yet crucial elements is the necessity of bonding and insurance. For many industries, these two components aren’t just optional; they’re essential for establishing credibility, securing contracts, and protecting finances. But what exactly do we mean by bonding and insurance? And which industries require them the most? This article will explore the Top Industries That Require Bonding and Insurance, offering insights into their significance and providing a comprehensive overview of why businesses in these sectors should prioritize getting bonded and insured.

Understanding Bonding and Insurance

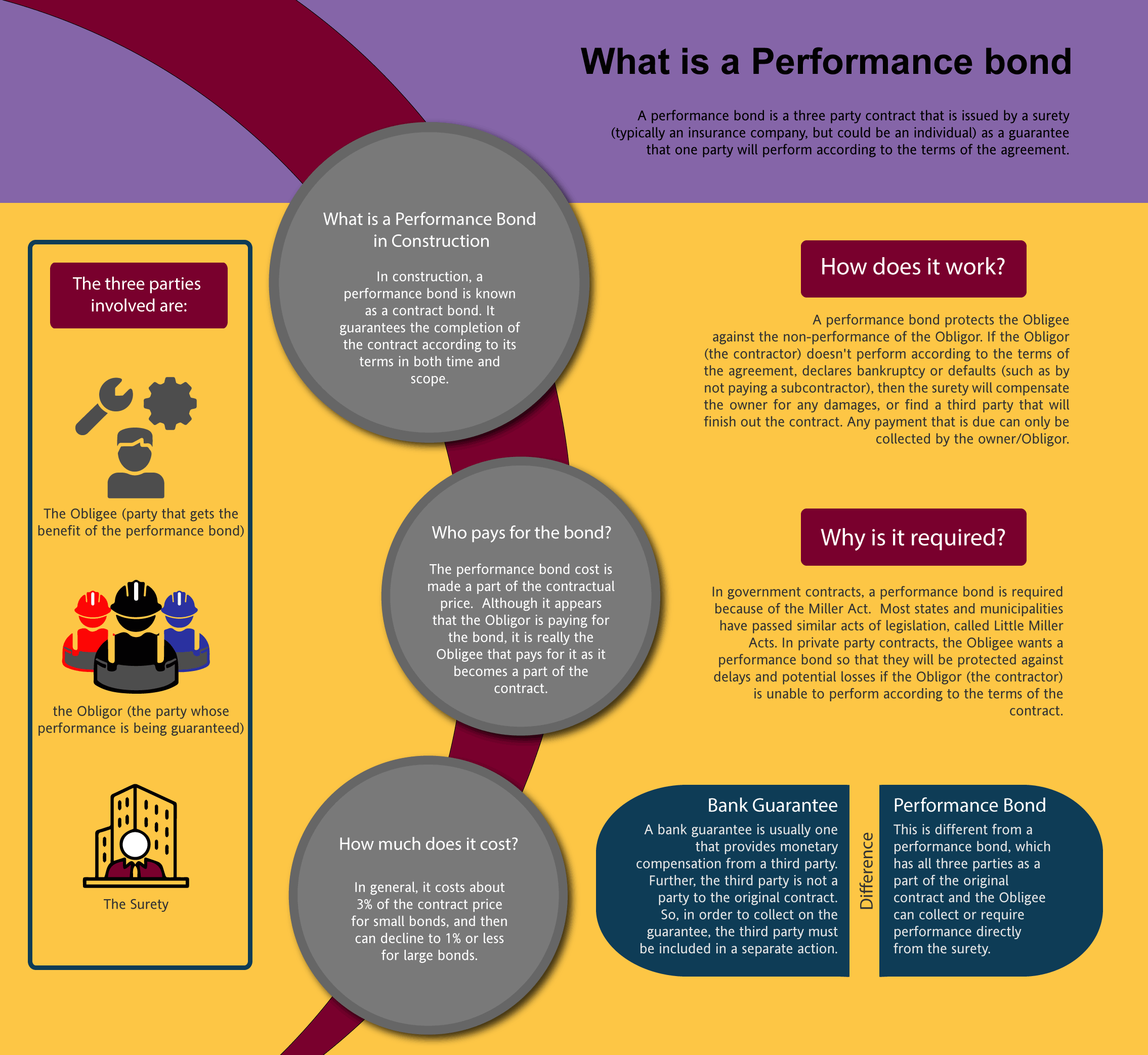

What is Bonding?

Bonding refers to a financial guarantee provided by a third party (often an insurance company) that ensures a contractor will fulfill their obligations as outlined in a contract. If the contractor fails to meet those obligations, the bond covers any resulting financial losses.

What is Insurance?

Insurance, on the other hand, protects businesses from various risks by covering potential losses from incidents such as accidents, theft, or natural disasters. It acts as a safety net that safeguards business assets.

Why Do Businesses Need Both?

While bonding guarantees performance, insurance protects against unforeseen events that could derail operations. Together, they create a robust framework for risk management.

Top Industries That Require Bonding and Insurance

Construction Industry

Overview of the Construction Sector

The construction industry is perhaps the most well-known sector that requires bonding and insurance. With numerous moving parts—from laborers to equipment—this industry faces significant risks daily.

Types of Bonds in Construction

- Bid Bonds: Assurance that contractors will honor their bids. Performance Bonds: Guarantees project completion according to contract specifications. Payment Bonds: Ensures subcontractors receive payment for their work.

Importance of Insurance in Construction

Insurance policies like general liability insurance protect against injuries on job sites or damage to third-party property. Without proper coverage, construction firms can face crippling lawsuits.

Healthcare Industry

Why Healthcare Needs Bonding and Insurance

In healthcare, patient safety is paramount. Facilities must maintain high standards to avoid malpractice claims or regulatory penalties.

Types of Coverage Required

Healthcare providers often need professional liability insurance to cover allegations of negligence or malpractice. Additionally, they may also require workers' compensation policies for employee protection.

Transportation Industry

Risks Faced by Transportation Companies

From accidents to cargo loss, transportation companies face various risks daily. The need for bonding ensures that carriers meet state regulations while protecting customers' interests.

Essential Insurances in Transportation

Liability insurance protects against damages caused during transit. Cargo insurance covers loss or damage to goods while being transported.

Real Estate Industry

The Role of Bonding in Real Estate Transactions

Real estate agents often require bonds to ensure they adhere to ethical standards and legal requirements in transactions involving client funds.

Necessary Insurances for Real Estate Agents

Errors and omissions (E&O) insurance protects agents from claims related to mistakes made during transactions.

Hospitality Industry

Unique Challenges Faced by Hotels and Restaurants

The hospitality sector must manage various risks—from foodborne illnesses to property damage—making it vital for businesses within this industry to get bonded and insured.

Types of Coverage Available

General liability coverage helps protect against customer injuries on premises while property insurance safeguards against losses from fire or theft.

Landscaping Services

Why Landscaping Requires Coverage

Landscaping services operate outdoors where accidents can easily occur due to machinery or environmental hazards.

Essential Policies for Landscapers

Liability coverage is essential for protecting against damages done during landscaping projects while equipment insurance covers tools used on-site.

Educational Institutions

Protecting Schools with Bonds & Insurance

Educational institutions must ensure compliance with regulations while safeguarding students’ welfare through adequate bonding and insurance policies.

Types of Coverage Needed

Schools may require liability coverage alongside specific bonds tied directly to educational funding or student enrollment guarantees.

Manufacturing Sector

Risks Associated with Manufacturing Operations

Given its complexity—managing machinery, raw materials, labor—manufacturing faces unique challenges requiring thorough bonding solutions alongside insurances tailored specifically toward operational risks involved in production lines.

How To Get Bonded And Insured

Getting bonded and insured may seem daunting at first glance; however, understanding each step understanding performance bonds simplifies this process significantly:

Assess Your Needs: Determine which types of bonds/insurance are necessary based on your industry. Research Providers: Look for reputable bond providers who have experience within your sector. Gather Documentation: Compile relevant financial statements along with proof of your company's legitimacy (licenses). Apply & Pay Premiums: Complete applications thoroughly before submitting them along with any required fees; once approved pay premiums timely. Maintain Compliance: Ensure you comply with ongoing requirements such as renewals or additional documentation requests periodically throughout your relationship with providers ensuring continued protection remains intact into future endeavors without interruption!Frequently Asked Questions (FAQs)

1. What does it mean when a contractor is bonded?

A bonded contractor has obtained a surety bond which guarantees their performance on contractual obligations; if they fail to deliver as promised—clients can make claims against this bond seeking compensation for losses incurred due non-compliance by said contractor!

2. Is it mandatory for all businesses to get bonded and insured?

While not every business legally requires bonding/insurance—it’s highly advisable across most sectors given potential liabilities involved especially those dealing directly with consumers!

3. How long does it take to get bonded?

The timeline varies depending upon factors such as type(s) requested but generally speaking expect anywhere between few days up until several weeks depending upon complexity surrounding applications submitted!

4. Can I get bonded if I have bad credit?

Yes! A poor credit history might limit options available though some surety companies specialize specifically assisting individuals/businesses facing difficult situations—thus allowing them opportunities still exist even under unfavorable conditions prevailing previously experienced financially speaking!

5. What happens if I let my bond lapse?

Letting your bond lapse can result in losing contracts which explicitly stipulate maintaining active status thus creating complications down line potentially affecting overall reputation negatively too!

6 How much does bonding cost?

Costs vary greatly based upon multiple factors including type required size scope respective projects undertaken typically ranging anywhere from 0%-15% total value associated each individual project needing undertaking done successfully executed properly mathematically speaking here!

Conclusion

In conclusion, understanding the importance of bonding and insurance cannot be overstated within various industries covered throughout this article—the complexities involved necessitate thorough examination prior engaging responsibly ensuring future growth sustained long-term without risking unnecessary exposure resulting damages incurred potentially harming overall prosperity achieved thus far! Therefore prioritizing efforts toward obtaining reliable policies alongside adequate protections serves dual purpose shielding both stakeholders interests alike enhancing trustworthiness among clientele leading ultimately greater success overall achieved moving forward no matter what field entered next!